Framing the Problem

There is a broad-based concern in the securities finance and collateral industry that a shortage of younger people entering the workforce will hurt the business going forward. Who will take over when the current generation of leadership retires? And while Business as Usual operations may not suffer, any new (or recycled) stress in the system may test the resilience of both the people and the markets as a whole. Business leaders tell us that they are trying a variety of strategies but are competing against societal forces that impede their progress. What then can turn the tide, generate more interest among younger people in securities finance and collateral specifically, and help maintain a robust workforce going forward?

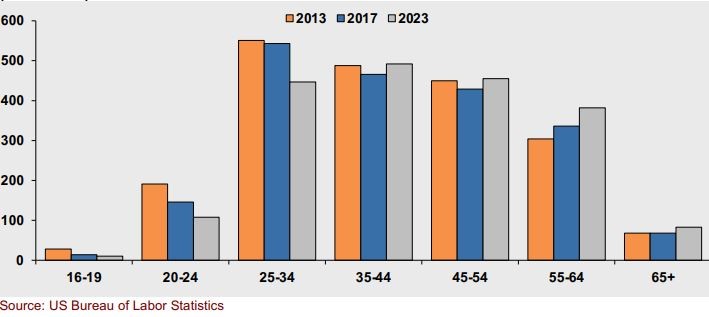

Employment statistics support anecdotal evidence that there are fewer young people working in capital markets than in prior years. According to the US Bureau of Labor Statistics, the number of individuals working in US banking and related services has fallen by 5% from 2013 to 2023, staying close to 2 million individuals. The age dispersion of employees however has skewed heavily towards older people. The number of 20–24-year-olds employed dropped 43% over the period, from 191,000 to 108,000 people, and the number of 25–34-year-olds dropped by 19%, from 551,000 to 447,000 people (see Exhibit 1). A decades-long trend of hiring fewer young people is also evident in the European Union. A 2018 study by the European Banking Federation found that “Hiring for people aged 55-plus swelled by 35%. Meantime, workers hired under the age of 24 decreased by 38%, while hiring for those aged 25-39 dropped 19%. The trend slowed in the 40 to 50 age category, down just 5%.”[1]

Exhibit 1:

US employment in banking and related services by age, 2013-2023

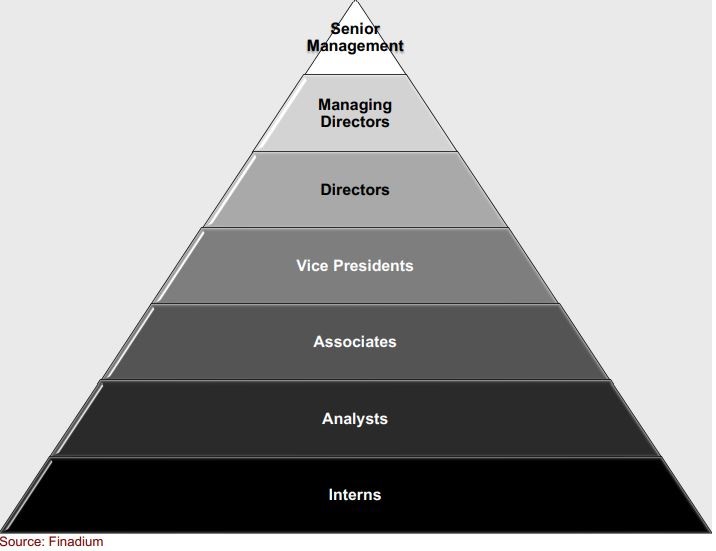

What happens in banking employment has had a historically outsized impact on other investments and financial technology businesses. The “up or out” mentality, where younger analysts would be promoted or leave an institution, meant that asset managers, technology firms and market infrastructures could hire from a group of newly released ex-bank employees with some experience already. It also meant that banks were drawing from an engaged participant group to staff thinning ranks of directors, managing directors and senior managers (see Exhibit 2). We know countless individuals who worked in a bank then left at some point in their career for a non-bank role (including ourselves). The further the pool of younger people in the banking system declines, the less opportunities there are for other firms to staff up without making larger investments themselves.

Exhibit 2:

Historical staffing model for a bank in capital markets

The Industry’s Perspective

By number of global employees, the banking industry has been the single largest actor when it comes to training young people. If banks reduce their intern and analyst programs then the rest of the industry feels the pinch. Asset managers, hedge funds and technology firms have entry-level hiring programs also, but those programs are too small to meet the future staffing needs of the broader capital markets industry.

Even the largest asset managers and hedge funds, now often referred to as a nonbank financial intermediaries (NBFIs), can struggle to hire and train enough young people. BlackRock commentary regularly cites human capital as a business risk. According to the firm’s 2022 and 2023 annual reports:

The failure to recruit, train and retain employees and develop and implement effective executive succession could lead to the loss of clients and may cause AUM, revenue and earnings to decline. BlackRock’s success is largely dependent on the talents and efforts of its highly skilled workforce and the Company’s ability to plan for the future long-term growth of the business by identifying and developing those employees who can ultimately transition into key roles within BlackRock.[2]

In technology, there seems little doubt that artificial intelligence (AI) and large language models (LLMs) are the path of the future, which means that there is less need for some junior staff as AI and LLMs reduce the busywork of banking. The replacement of junior and clerical staff results from efforts by senior managers across banks, asset managers and technology firms to streamline redundancy and eliminate menial tasks that a computer could do. The New York Times reported in April 2024 that, as a result of AI:

Top executives at Goldman Sachs, Morgan Stanley and other banks are debating how deep they can cut their incoming analyst classes, according to several people involved in the ongoing discussions. Some inside those banks and others have suggested they could cut back on their hiring of junior investment banking analysts by as much as two-thirds, and slash the pay of those they do hire, on the grounds that the jobs won’t be as taxing as before.[3]

In securities finance and collateral specifically, we have not heard senior managers talk strategically about eliminating positions although this is a natural side-effect of technological innovation, and has been for decades. But even when there is an attempt to replace senior people with younger employees (“juniorification”), that doesn’t mean that the new hires are well trained or experienced enough to take over complex tasks.

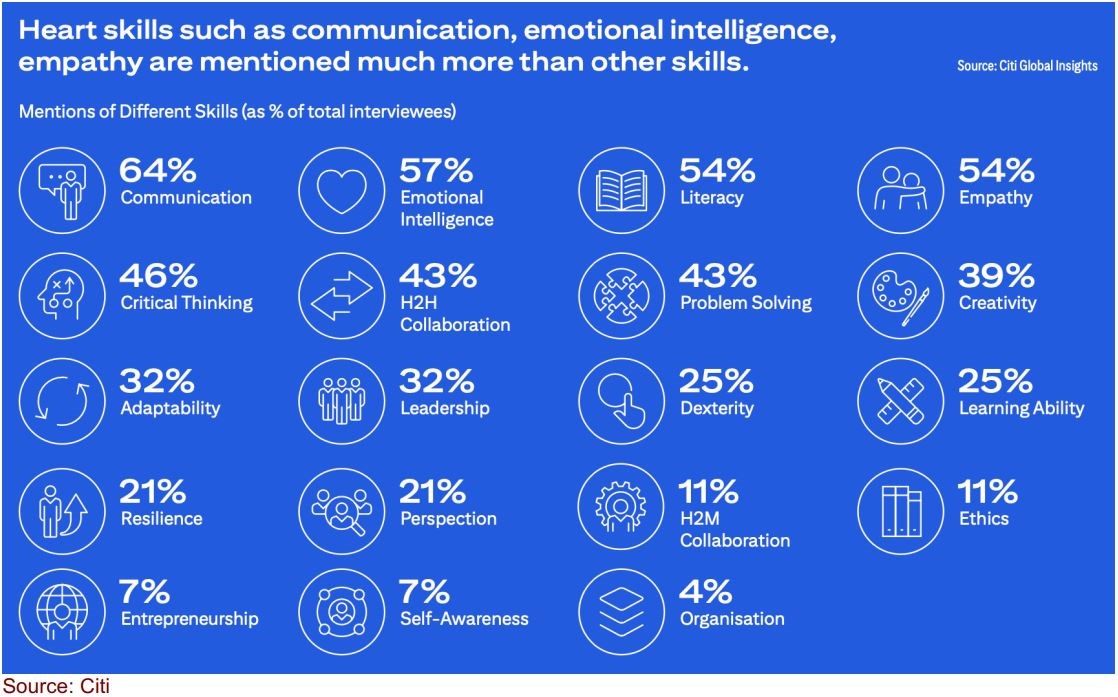

On the other end of downsizing, there is popular thinking that AI and LLMs can produce a “jobs boom” if the right skills are taught and employed by the work force. A recent report from Citi, “What Machines Can’t Master,” found that AI now beats human performance at reading comprehension, image recognition and language understanding, but not yet grade school math.[4] On the other hand, computers are not close to outshining humans at dexterity, “heart” or cognitive skills including change management. Communication and emotional intelligence should remain a human-dominant trait for years to come, along with empathy and critical thinking skills (see Exhibit 3). The task then is combining the use of AI and LLMs with financial markets intelligence to ensure delivery of daily tasks and protect against market or operational disruptions.

Exhibit 3:

Where humans beat AI and LLM

The Entry Level Person’s Perspective

For their part, younger people no longer seem as attracted to banking as they were before the Global Financial Crisis. The anecdotal reasons we hear from our college-age friends are that “banks are evil,” “I don’t want to sit at a desk all day getting yelled at,” and “your work is incredibly boring.”[5] Frequent layoffs and unpleasant working conditions for younger staff are reported regularly in the press, including the well-known presentation by a group of Goldman Sachs investment banking analysts on why their positions were horrible, to put it politely. A quote from the 2021 unofficial Goldman Sachs junior investment banker Working Conditions Survey noted that “The sleep deprivation, the treatment by senior bankers, the mental and physical stress…I’ve been through foster care and this is arguably worse.” (Original bold and emphasis.)[6]

With this much negative publicity, banks may be drawing from an unlimited pool of applicants but a limited pool of applicants that they want. Further, banks are looking for hires that could become truly devoted to a career in banking. While the challenging working conditions of investment banking do not usually extend to securities finance and collateral, the segment can suffer from reputational association.

Against this backdrop, securities finance and collateral needs another plan to develop, attract and retain staff to succeed into the future. AI and LLMs will play a role, but there is also a requirement for smart people who understand how the business works and who the key players are. As multiple stressed markets have shown, this is when the expertise is truly required, and phone calls between the right people (including regulators and regulated institutions) can calm a market before things turn truly ugly. The right staffing now can save a world of hurt later on.

This opinion is published with the kind permission of Finadium LLC. Finadium is a consulting, data and market intelligence company in capital markets, with a specialty in securities finance, collateral and derivatives. We deliver primary surveys, regulatory and product analyses for the benefit of global market participants, made available as the Finadium Subscription. These analyses are the foundation of Finadium’s ongoing work in advisory, data collection and event production. Our clients include banks, dealers, hedge funds, asset managers, pensions, central banks, regulators and technology firms.

Given the risks to financial stability when these basic financial services operations are not properly handled, Finadium's work with banking and capital markets supervisors has been especially important.

For readers wishing to get the entire report, the contact information is info@finadium.com, or tel: +1-978-318-0920

References

[1]- “Experienced older workers in high demand,” European Banking Federation, June 28, 2018, available at https://www.ebf.eu/social-affairs/experienced-older-workers-in-high-demand-as-eubanks-seek-staff-competent-in-regulation/

[2]- BlackRock Annual Report 2022, available at https://s24.q4cdn.com/856567660/files/doc_financials/2023/ar/BLK_AR22.pdf

[3]- “The Worst Part of a Wall Street Career May Be Coming to an End,” New York Times, April 10, 2024, available at https://www.nytimes.com/2024/04/10/business/investment-banking-jobs-artificialintelligence.html

[4]- “What Machines Can’t Master,” Citi GPS, May 2024, available at

https://ir.citi.com/gps/eaxy8PuU5wkCM0n-pPJ2rKHv2-YlOCvbyXwAXpO2gGllWBORUgW5_E_xKOou1LiJtVrAFeSgRugppI7CkuaVGcOfXBxpktAJCzsr00JffX5EadbUXUYcQBcjQKP7_zKKIKY411r7OpiwpirS4XA%3D%3D

[5]- The last is a direct quote from a young person in one of our own households.

[6]- “Working Conditions Survey,” Goldman Sachs & Co LLC, February 2021. Reportedly produced by a group of young analysts and not by Goldman Sachs & Co. or endorsed by same. Available at

https://fd-binary-external-prod.imgix.net/JHxu13NMxHm3PvR1NCk1YL3z5Pw.pdf