How Much?

In the center of financial services systems, one vast and critical business area does not seem to attract the noisy news coverage its peers in capital markets, investment management, and banking do: the estimated global value of insurance premiums paid in 2020 was $ 6.3 tr, up just over 1% over 2019 according to the Insurance Information Institute. That is a significant cash inflow. The estimated value of insurance portfolios was $ 36.3 tr in 2019, an inexact match for the data due to a reporting problem, but one can get an idea of the proportions.

Insurance is not exactly a world apart, and the adjective 'quiet' to describe it should probably be good news. Quiet does not mean that insurance is hidden away: there is far more to this business than the dry mathematical results of actuarial estimates. With this amount of money at stake, what is noteworthy for insurers as 2022 begins?

This opinion aims to make some noise about insurance precisely because this segment is crucial to every international financial center.

Who?

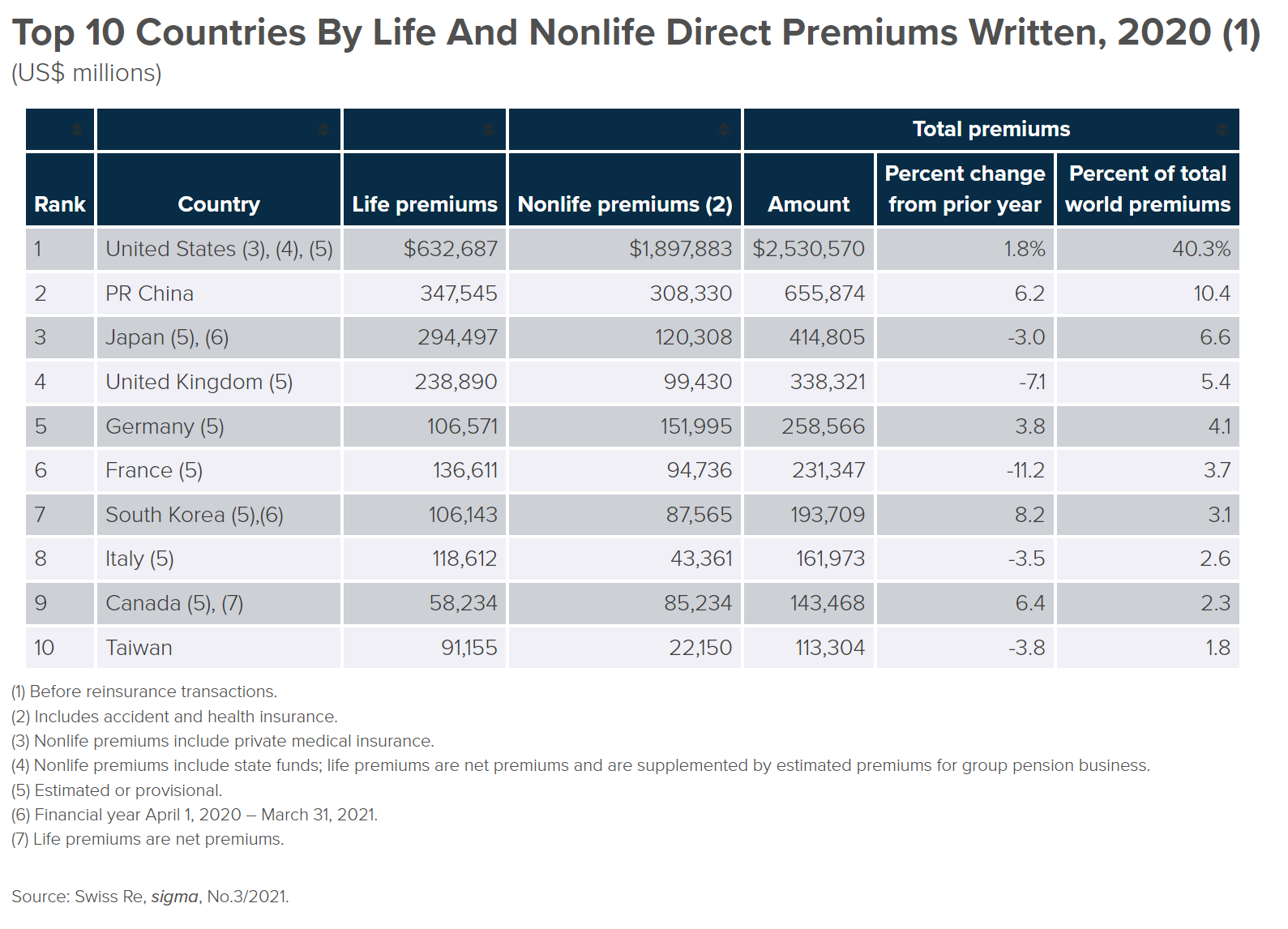

The sheer scale of the world's insurance businesses gives rise to questions of financial stability, a reality that has not gone unnoticed by global financial policy-makers. The International Association of Insurance Supervisors (IAIS) was established in 1994 as a voluntary membership organization. By the start of 2022, its membership came from more than 200 jurisdictions, and they oversee insurance corporations and mutuals, constituting 97% of the world's insurance premiums. The insurance industry remains heavily skewed to ten countries, as the table at the end of this opinion shows, although its investment portfolios doubtless spread further.

The IAIS is the international standard-setting body responsible for developing and assisting in the implementation of principles, standards, and other supporting material for the supervision of the insurance sector. The IAIS also provides a forum for its Members to share their experiences and understanding of insurance supervision and insurance markets. In recognition of its collective expertise, the IAIS is routinely called upon by the G20 leaders and other international standard-setting bodies. The 26 Insurance Core Principles agreed by IAIS are part of the Financial Stability Board Compendium of standards for the world's financial system; they give guidance to insurance supervisors in their home markets, not guidance directly to the insurers themselves.

The mission of the IAIS 'is to promote effective and globally consistent supervision of the insurance industry in order to develop and maintain fair, safe, and stable insurance markets for the benefit and protection of policyholders and to contribute to global financial stability.' The central purpose of the IAIS is, without any irony, the main problem: to have effective and globally consistent supervision. However hard global principles and standards are for every business segment, that is the right objective for policy-makers.

The activities of the IAIS are supported by its Secretariat located at the Bank for International Settlements in Basel.

What?

As 2021 ended, what questions were being fielded by the IAIS and its various committees? The Town Hall it convened late in the year highlighted key concerns:

Climate scenario analysis: Developing the tools to understand climate risk

The first panel focused on emerging good practices in climate scenario analysis for insurers. The steps supervisors can take both to use this as an effective risk assessment tool for insurers and as a macroprudential analytical tool for themselves. IAIS will work on further guidance to support supervisors as they develop scenario analysis requirements. The complexity of the task touches the development scenario analysis and the use of these same models to get good outputs.

The best approach is for insurers to take the first step by starting work to understand and assess the climate risks of their clients and what may be in their investment portfolios. Panelists set out the trade-offs that influence the complexity of such exercises. They agreed on the need not let the 'perfect be the enemy of the good' and highlighted the benefits of starting work now. Insurers need to develop the internal corporate knowledge to understand these risks better and then integrate climate considerations into Enterprise Risk Management (ERM) and medium- and long-term strategic decision-making. The panel concluded that for supervisors, this means considering how climate risk analysis is informing decisions that firms are making and standing ready to ask insurers' senior managers about how they are factoring in this risk.

Global Monitoring Exercise: A changing landscape for the insurance sector

The IAIS conducts an annual Global Monitoring Exercise (GME), particularly this year, focusing on the risks and strategic challenges regarding credit and cyber risks. This second panel considered what this means for insurer business models, how consumers might be affected, and what steps supervisors can take to help ensure these risks are effectively managed.

The panel considered how the private equity industry is increasingly acquiring life insurance businesses in certain jurisdictions as they seek steady capital inflows into their fund offerings. In the light of record levels of sovereign and corporate debt, the panel discussed the credit risk associated with these developments, what risks this could pose for insurers, and the focus that supervisors need to give to ensure these risks are adequately managed.

The panel concluded by discussing the growing risks from cyber threats to businesses. Data on cyber exposures of insurers is limited, while data on accumulation risk related to cyber policy underwriting is even less available, posing challenges for cyber insurance pricing and reserving. The conclusion is that conservative underwriting is warranted and that the industry must remain cautious given the current sparsity of data.

Pandemic risk: The role of supervisors in addressing future pandemic risk

The discussion then moved to pandemic risk to consider insurers, governments, and supervisors' roles in addressing the pandemic protection gap. The panel discussed options for covering this risk and the extent to which public and private sectors would be called on to address the risk. The panel agreed on the need for supervisors to be involved in the development of any public-private partnership arrangements.

In the Town Hall audience poll, almost two-thirds of the audience thought that the most effective way of addressing the pandemic business interruption protection gap is through public-private partnerships, with only 27% believing that government-funded schemes and stimulus packages on their own could address these risks.

Panelists highlighted the different challenges faced in emerging and developing economies, where insurance markets are not as developed and have greater fiscal constraints. The panel also discussed the extent to which emerging risks will challenge the capacity of traditional insurance models to provide cover in the future, with more than half of the audience believing this would be the case for climate risk.

Innovation: Governance and ethics of artificial intelligence and machine learning

The panel sessions concluded with a discussion on governance and ethics stemming from the use of artificial intelligence (AI) and machine learning (ML) in the insurance sector. Within this rapidly evolving area, the panel considered what impact it would have on policyholders and insurers. They examined how governance frameworks could address inherent biases in underlying AI-ML models in terms of diversity, equity, and inclusion. They also discussed the importance of the boards of directors of insurers understanding these risks and being clear on the monitoring and controls that need to be put in place to mitigate these risks. Panelists agreed on the need to focus less on the AI tools being used and think more broadly about the data sets and whether they come with their own biases. In the audience poll, all respondents agreed on the need for some additional regulation, with 43% calling for a principles-based approach to addressing these issues.

What Else?

The late 2021 IAIS newsletter articles highlighted the balance sheet management problem after years of low or negative real interest rates. In a highly regulated environment, Insurers themselves have had to make contractual payouts according to calculations that had been made years ago. The imbalance created has lasted more than a decade since the Global Financial Crisis of 2008-2009; what seemed to have been a temporary corrective measure for a tremendous economic shock has slowly transformed the investment/risk trade-off for the entire industry.

The twin questions of solvency and liquidity are critical and permanent for the insurance industry agenda. They will always be subject to debate and revised assessment as they should be.

Appendix – The Concentrated Insurance Industry

Ten countries constituted 80% of the world's insurance industry in 2020, as measured by premiums paid.