WAIFC in partnership with Revolve Circular hosted a roundtable on Financing the Circular Economy

Welcome remarks:

- Dr. Jochen Biedermann, Managing Director, WAIFC

- Sören Bauer, President, REVOLVE Circular

Introductions:

- Cornelia Meyer, Chairman & Chief Economist, LBV Asset Management

- Patrick Schröder, CE Policy Expert, Chatham House

- Reinier van der Vusse, Circular Economy Debt Fund / Fund Manager, Polestar Capital

- Prof. Naoki Tamaki, Japan Bank for International Cooperation JBIC

Roundtable discussion:

- WAIFC member & observer representatives

- Above-mentioned speakers

- Karsten Loffler Managing Director, Green and Sustainable Finance Cluster Germany

- Moderated by Sören Bauer, President, REVOLVE Circular

Closing remarks:

Teuta Oruçi, Founder, Cleantech 360

Background:

Attended by a range of high-profile economists, experts, fund managers and WAIFC members, the purpose of the roundtable was to raise awareness about Circular Economy models. Sustainable finance has often been discussed in linear terms but delegates agreed that the necessity to maintain biodiversity and financing the transition requires adopting principles of a “Circular Economy”. So, what is a Circular Economy and why should the finance industry take heed?

We already consume more natural resources and raw materials than the earth can provide – and resource use is likely to increase. With the world’s population likely to increase by 2.5bn people by 2050[1], energy use and an “energy mix” will be increasingly important to avoid an imbalance between developed and developing economies. Nature’s absorption capacity of synthetic materials, both quantitatively and qualitatively, is of course limited (e.g., plastic in the oceans). The current approach via the linear economy – or “take-make-waste approach” – uses resources in a highly inefficient manner. Climate and biodiversity are negatively impacted. So, what does a Circle Economy model propose?

Definition and models:

According to the Ellen McArthur Foundation, Circular Economy is defined as “a systems solution framework that tackles global challenges like climate change, biodiversity loss, waste, and pollution”.[2] Speakers discussed that within this context waste elimination, pollution, material usage, and end-of-life considerations of materials are taken into consideration from the start. Resources can be circulated and help tackle climate change and biodiversity loss. Currently, it is estimated that less than 10% of the global economy is circular (Circular Gap report, Circle Economy)[3] which shows the level of wastage but also the opportunity to make an impact. As one speaker suggested during the roundtable “Circular models are a low-hanging fruit particularly within sectors on the demand side within construction and energy sectors”.

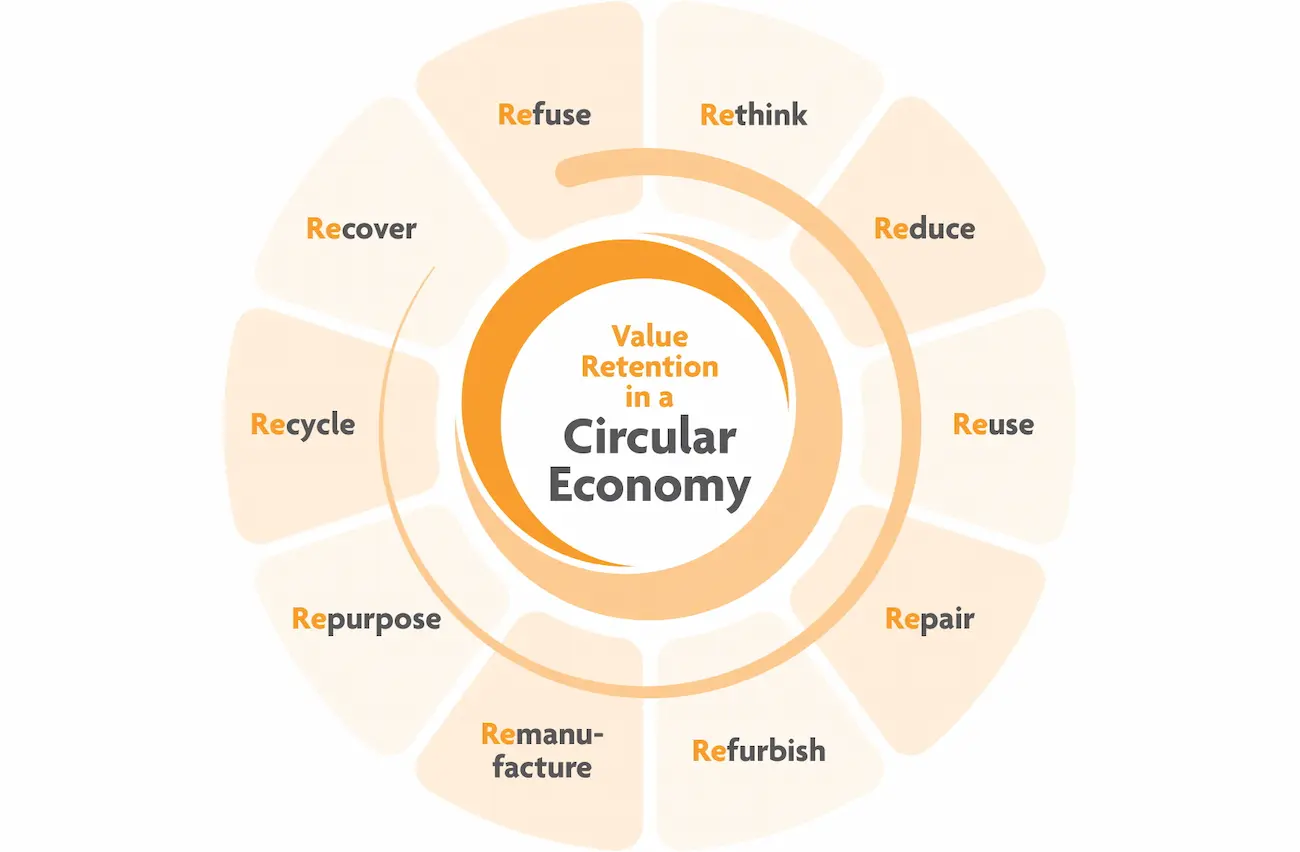

Various models to retain value within a Circular Economy are published, considering a 3R approach. Reduce, Reuse and Recycle. Others propose between 10 to 30 Rs exit and suggest going beyond the three mentioned above and taking into consideration Rethink, Reduce, Reuse, Repair, Remanufacture, and Repurpose. The European Commission published a Categorization system for a Circular Economy[4] covering 4 broad business models:

- Recovery of materials and Circular Inputs. Here we see recycling but material loses value and does not retain it.

- Sharing Economy- where products can be used more as a service (think share vehicles etc.)

- Circular Design-change the way products are produced

- Circular Enablers- Digitization has a huge role to play as moving to a Circular Economy requires data that can be used by governments and financial institutions.

Sectorial anecdotes:

Delegates did discuss the broadness of the term Circular Economy and whether it was well defined. Many instruments under the guise of Circular Economy relate to Sustainable Finance (i.e., Green Bonds) and are not specific to Circular Economy. The response of a fund manager was that we find ourselves in the beginning phase of the transition and that we have instruments but we now need to add Circular Economy approaches to these instruments. Starting from the point that Circular Economy is about resources and materials and decreasing wastage and emissions in the product design phase is the approach we need the industry to apply. Take the example of architects building houses considering waste and repair from the start. This would serve the longer lifespan and environmental impacts of building and refurbishing the house and eventually the end of life of the house.

From the perspective of the energy sector, 800m live in energy poverty. By 2050, 2.5bn could be in energy poverty so we need “every electron, wind gust and solar ray to help reduce the energy gap”. The Circular Economy model can help take carbon out, and capture carbon to further utilize and store and we need to stand for an Energy for all approach beyond just an Energy transition. The International Energy Agency suggested that currently 50% of the tech needed to get to the net zero goals is not yet commercial or yet invented.

Role of financial centers:

Policy Experts that track various Circular Economy policies suggested that up to 500 policies exist around the world, predominately driven by the European Green Deal.[5] Financial centers around the world that sometimes work with or shape policy for the regulatory environment for their local governments have a huge role to play to understand global best practices when it comes to Circular Economy. E.g., working with the private sector to develop models and stimulate the financial sector to address the growing demands from investors and shareholders for financing instruments. Other considerations for financial centers include:

- Investments in low- and middle-income countries in the transition from a linear to a circular economic model are crucial, particularly in the context of the COVID-19 recovery. This will help address creating a divide in the Circular Economy between Developed and Developing economies.

- For circular economy finance to become sustainable and socially inclusive, it will be necessary to adopt and internalize new ideas, such as the concept of a ‘just transition’.

- Initiatives such as the EU’s Green Taxonomy provide an opportunity to create binding and commonly adopted financial standards and guidelines for circular economy investments.

Currently, it is estimated that 3-4% of global spending is on the Circular Economy[6] demonstrating the scale of the opportunity for governments and businesses to adopt better approaches. According to Lawlor and Spratt (Circular Investment, 2021)[7], “Circular business models” provide the biggest appetite for investment being classed as “the largest source of investments in companies that want to transition to more circular activities, or, more commonly, that want to create new circular technologies or products”. Circular business models are often new models and are quite unusual and not familiar to Financial Institutions (e.g., shared models) and are generally smaller scale companies, start-ups by nature, and become harder to finance. Hence awareness of such models, principles of Circular Economy, and options need to be discussed by the entities that influence the financial sector and this is the role financial centers can play to help move the world to a more Circular Economy.

This was another roundtable in a series of activities the World Alliance of International Financial Centers (WAIFC) has hosted in relation to Sustainable Finance and the first pertaining to Circular Economy. If you are interested to discuss these activities or partnering with us on further activities, please contact us.

[7] https://www.chathamhouse.org/2021/07/financing-inclusive-circular-economy/04-financing-circular-economy-transition-post-covid-0

[6] https://waste-management-world.com/artikel/1-3-trillion-in-global-circular-economy-spend-proves-insufficient/

[5] https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en

[4] https://research-and-innovation.ec.europa.eu/knowledge-publications-tools-and-data/publications/all-publications/categorisation-system-circular-economy_en

[3] https://www.circle-economy.com/news/our-world-is-now-only-8-6-circular

[2] https://ellenmacarthurfoundation.org/topics/circular-economy-introduction/overview

[1] https://blogs.worldbank.org/opendata/worlds-population-will-continue-grow-and-will-reach-nearly-10-billion-2050