Second FinTech Webinar with Findexable: Enabling a great leap forward?

The second in the series in partnership with Findexable continues our theme looking at how the world and financial services, in particular, is resetting for a new reality - and the challenges and opportunities this will create.

In line with last week’s session, where the focus centered on protecting SMEs and building resilience for the future, smaller hubs in Europe and the Middle East are seizing the opportunity of digital to drive home the message that size is no disadvantage - and that fintech for a post-COVID reality is about a connected mindset as much as about physical location.

Today’s conversation highlighted 5 key areas that will drive the future of financial services and help position them at the crossroads of the post-pandemic economy:

- Digital has shifted gear. And distinctions are blurring

If coronavirus made organizations sit up and take notice of what many had been saying about the importance of digital before the pandemic, its aftermath will consign the debate to history. Digital is not an either/or strategy. It’s becoming the only show in town. While this might sound self-evident it will mean distinctions between innovative new entrants and institutional incumbents blur and challenge a re-thinking of the purpose of financial services to prioritize wider global social and environmental goals. - Diversity - of industries, of markets, and people

The financial services industry has always been globally oriented. It’s just that ‘global’ was limited to a handful of centers in the West and an industry dominated by a largely white, male workforce. A decade of fintech has already challenged those assumptions - and the success of new ecosystems like in Doha, as well as Asia’s innovation boom, is proof of the potential of fintech to enable entrepreneurship and deepen economic diversification. A more digital world can open new talent corridors, irrespective of physical location - and create more opportunities (in more parts of the world) than ever before. - Help the helpers - innovation can’t flourish by default

Despite the progress and the ‘digital bump’ that coronavirus will enable innovation is more than about the gal, or the guy, in a garage. Thriving innovation ecosystems rely on the support of incumbents, government, and business - to get access to customers, make it easier to set-up shop, and particularly in emerging markets to onboard new customers. Locations with established thriving financial industries like Hong Kong and Luxembourg can work with incumbents to create synergies and enable an innovation dividend that benefits everyone. - Wave-makers not rule-makers

Before the pandemic protectionist tensions were running high. While financial services organizations were wary of the potential threat to globalization our panel was in agreement that a crisis of this nature requires globally coordinated responses - and expressed optimism for a renewed impetus to drive connectivity between regions. It might be too early to talk of a new wave of global financial standards - but the role of global organizations that can help mediate and articulate the challenges to regional regulators is more critical than ever. - Winds from the East - Asia’s century

No future-focussed conversation can ignore the shifting global perception of Asia. Effective management of the response to the coronavirus to one side - the breadth of Asia’s digital ecosystem and consumer adoption of innovative financial services means the region is already leading the world. As the world comes out of hiding Asia will increasingly become the focal point - for innovation investments, talent, and consumers.

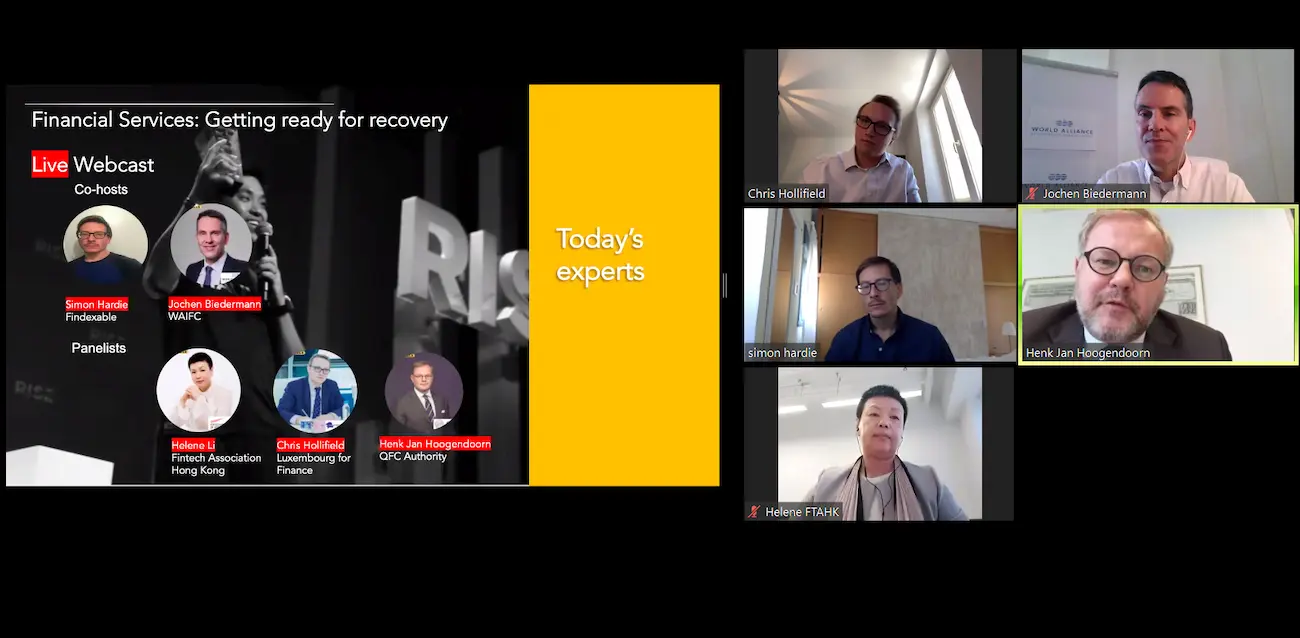

We’d like to thank today’s participants for a really enlightening conversation:

- Helene Li, General Manager, FinTech Association of Hong Kong

- Chris Hollifield, Manager, FinTech & Business Development, Luxembourg for Finance

- Henk Jan Hoogendoorn, Managing Director Financial Sector, Qatar Financial Centre (QFC) Authority

And of course our co-hosts - Simon Hardie, CEO of Findexable, and Jochen Biedermann, Managing Director of the WAIFC.

#FinanceForGrowth